Author Archive: Peter G. Miller

IF YOU ASK ME: Tooth or Consequences

In our modern, progressive society there used to be two universal constants upon which one could always count — the speed of light and a fear of dentists. While light continues at its usual pace, the practice of dentistry has changed remarkably. The term “remarkably,” in this case, means for the better. It must be […]

Obtainium for Fun & Profit

Obtainium is everywhere. People throw stuff out that’s perfectly usable. Often it’s there, on the street or a community web page, waiting to be picked up for free by anyone who can see the potential. Obtainium is environmentally justified. It conforms absolutely with the environmental mantra to reduce, reuse, and recycle. Creating obtainium is also […]

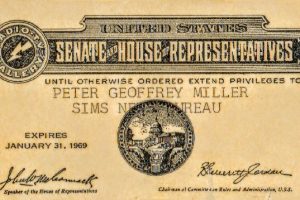

How I Became A Successful Writer For More Than 50 Years

How can you become a successful writer? My answer began more than 50 years ago. It was in 1968 when I got my first writing job. I was going to the American University in Washington, DC and there was a sign on the job board looking for a Capitol Hill correspondent. I was a journalism […]

Please Don’t Move To Pensacola

Please don’t move to Pensacola. Seriously. I know it has superficial attractions like miles of clean beaches, real estate costs which are a third, or a fourth or a fifth of home values in hip-and-happening major metro areas and sure, you can easily park on the streets downtown, but do you really want to […]

Mortgages: Should We Jail Optimistic Economists?

In Italy seven people have been indicted for failing to predict an earthquake that killed more than 300 people. “Six Italian seismologists and one government official will be tried for the manslaughter of those who died in the earthquake that struck the city of L’Aquila on 6 April 2009,” reports Nicola Nosengo with Nature News. “The […]

Toxic Loans: The Coming Storm

It’s been a very good century for real estate, at least so far. According to the National Association of Realtors, the typical home that sold for $139,000 in 2000 was worth $208,700 in 2005. Not only have home values increased, unit volume has also grown. There were 5,152,000 existing home sales in 2000 compared with […]

April 15th: The Right Way To Figure Taxes

With April 15 now upon us a question lingers: Isn’t there a better way to deal with this annual effort to find receipts, stubs and numbers that balance? My interest in taxes is both economic and genetic. My late father was a CPA for more than 60 years and at age 90 or thereabouts was […]

Books by Peter G. Miller (OurBroker)

In response to many inquires, here is information regarding books by Peter G. Miller. More than 300,000 Miller books are in print. 1- The Common-Sense Mortgage: How to Cut the Cost of Home Ownership by $50,000 or More First published by Harper & Row in 1985, this book was widely considered the standard guide to real […]

What’s A Qualified Mortgage (QM)?

One of the better ideas to come out of the Dodd-Frank Wall Street Reform and Consumer Protection Act was to create something called a “qualified residential mortgage.” You want to know about such financing because most lenders offer little else. Under Wall Street reform several federal agencies have worked out a definition of the term “qualified mortgage” or […]

Is The Dow A Good Measure of Stock Market Success?

Like oxygen, reports on the daily doings of the Dow Jones Industrial Average are everywhere. It’s the fastest way to check Wall Street’s pulse. It’s the one benchmark most likely to be quoted in the morning paper and the nightly news. There are 30 companies which comprise the DJIA, but not the same companies all the […]