April 15th: The Right Way To Figure Taxes

With April 15 now upon us a question lingers: Isn’t there a better way to deal with this annual effort to find receipts, stubs and numbers that balance?

My interest in taxes is both economic and genetic. My late father was a CPA for more than 60 years and at age 90 or thereabouts was renowned both for driving an Alfa Romeo and auditing complex corporate books.

At an early point my father took me aside to explain the facts of life. I’m not sure I remember all the details, but in the midst of this discussion he mentioned something about the necessity of paying taxes, and to help in this endeavor he provided a calculator.

Now you might think, aha, a “calculator,” one of those electronic thingies that are now so cheap they’re given away in cereal boxes. Nope. This was before electronic calculators and not much after the invention of writing.

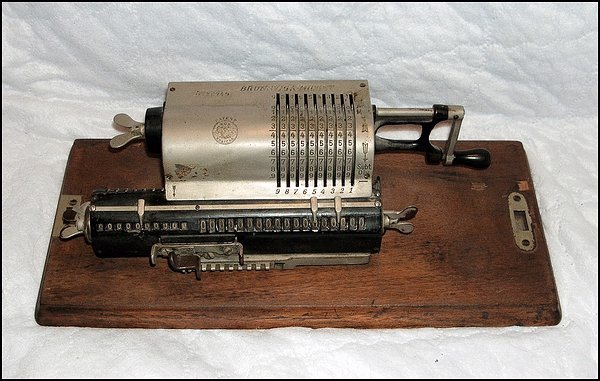

My father endowed me with a 12-pound Brunsviga-Midget, a 1910 device that requires neither batteries nor electricity. Instead, it consists of a sturdy oak board topped with a crank-powered collection of steel cogs and gears. By adjusting studs on a series of metal tumblers, turning the crank and moving a sliding registry, one can add, subtract, divide and multiply up to 18 places with absolute accuracy.

Taxes and Shoe Boxes

Thus armed with vast computational power, I have attempted over many years to violate the norms of financial sanity and common sense by doing my own tax returns. Each April I dutifully review all receipts and records assembled in a suitable shoe box, then sort and re-sort into various categories, enter the results by hand onto whatever forms the government suggests, add and subtract as appropriate and pay whatever it is I owe.

This system worked fairly well at the beginning of my adulthood. However with each passing year, the process has become less effective. While early returns could be mailed with a single stamp, the latest models vie with a Stephen King novel in terms of heft and complexity.

And although the part about the shoe box and the receipts remains largely unchanged — I’m sure Enron used the same system — figuring out what it all means has become decidedly more tangled. In an effort to spare the Brunsviga, I have sometimes resorted to paid assistance. But this year I decided to do something different: I broke down, spent $29.95 and bought the software necessary to complete my federal and state tax returns.

Better Results?

I’m not convinced that the results produced by this electronic wonder are especially different, or different at all, from the final figures that might have emanated from the Brunsviga. However, even I am awed by the ability of such software to automatically fill in lots of forms at once, write legibly and instantly generate 26 pounds of financial reportage.

It’s the end of an era. But although there is much to recommend the newest technological advances, I’m not certain society benefits.

Government is powered by taxes, and the more we know about who pays and who doesn’t, the better we understand how government works and what it really costs. When taxes are calculated on the dining room table with much sweating, cursing and irritation, we at least partake in the system; the usual distance between government and the governed disappears.

It’s All Clear To Me Now

For instance, this year you can write off state sales taxes if you do not deduct state income taxes. This is a benefit largely for folks who live in areas without a state income tax. Makes sense — until you read the rules.

“State taxes on motor vehicles,” says one government directive, “also are deductible as a general sales tax if the tax rate was more than the general sales tax rate, but the tax is deductible only up to the amount of the tax that would have been imposed at the general sales tax rate.”

Right.

Do your taxes using a computer program and you may not notice that medical bills equal to 7.4 percent (or less) of your gross adjusted income are not deductible — you need to be sicker to get write-offs. Given that we live longer, isn’t it time we reserved an extra write-off for those age 75 rather than comparative youths who have just turned 65? Why are there special write-offs for farmers, day-care providers and the clergy — but not for nurses or ambulance drivers? Who do you really need if your appendix bursts?

Taxes and Deductions

The issue is not so much that such limitations exist; rather it is the fuzzy process that produces them, the evidence of who has political power and who doesn’t.

Great industries have been created from single and obscure paragraphs hidden within the tax code, a body of rules so complex no one fully understands what’s been written or why. Truth is, automating returns undermines the common good. Rather than speed and efficiency, perhaps we need a tax system that makes citizens ask tough questions and causes political leaders to squirm every time they spend our dollars.

The time has now come to pass on a great tradition. Shall it be the Brunsviga or the software? Oh, children, Daddy wants to talk to you . . .

————————————

Published originally by the author in The Washington Post, April 18, 2005.